By mid-2025, hospital pharmacies across the U.S. and Europe are running out of basic antibiotics, blood pressure meds, and insulin - not because of factory fires or natural disasters, but because the manufacturers can’t afford to make them anymore. The root cause? A brutal squeeze: pricing pressure and manufacturer financial strain are collapsing the economics of generic drug production. What used to be a low-margin, high-volume business is now a losing proposition.

Why Generic Drugs Are Disappearing

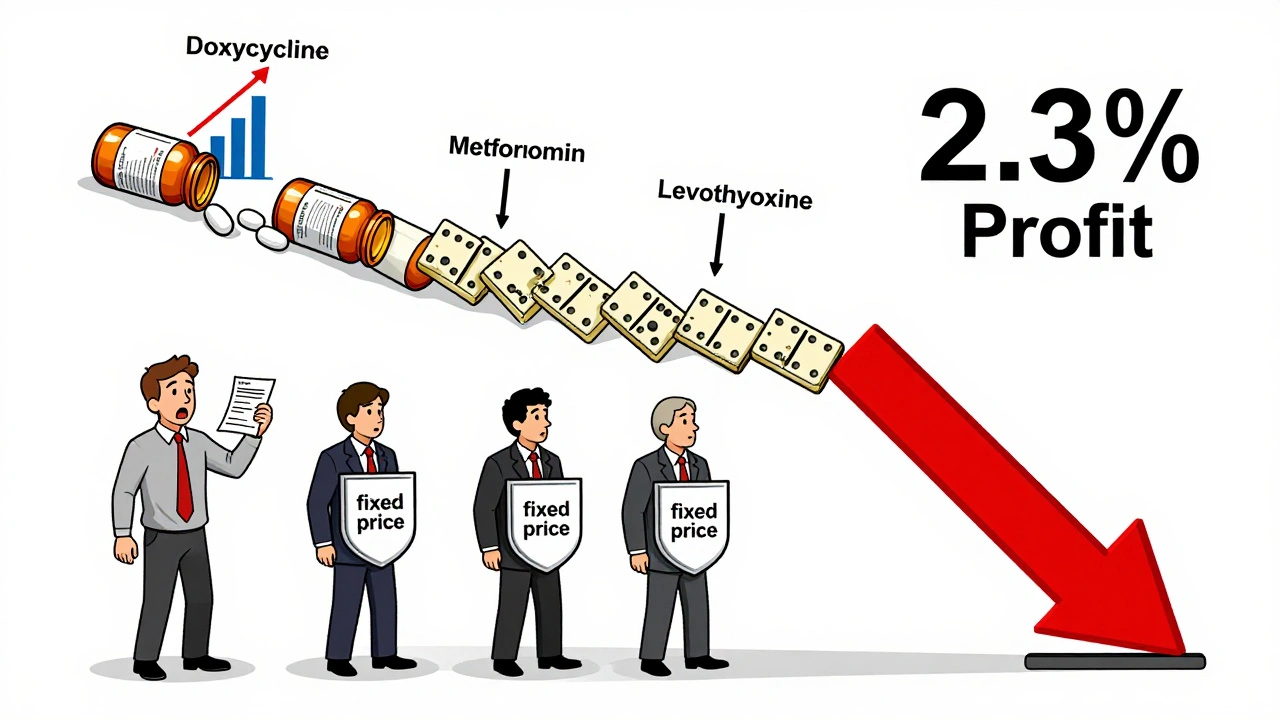

Generic drugs make up 90% of prescriptions filled in the U.S. But they account for less than 20% of total pharmaceutical spending. That’s because they’re cheap - sometimes under $1 per pill. For decades, this worked. Manufacturers could produce millions of pills at low cost and still profit from volume. But in 2025, that model is breaking. Raw material costs for active pharmaceutical ingredients (APIs) have jumped 18% since 2023, according to the U.S. Food and Drug Administration’s 2025 Supply Chain Report. Key ingredients like benzyl alcohol, magnesium stearate, and citric acid - once sourced reliably from India and China - now face tariffs, export bans, and labor shortages. The 2024 U.S. trade policies added 12% to 15% in tariffs on API imports from key regions, and manufacturers can’t just raise prices to cover it. Why not? Because pharmacies and insurers won’t pay more. Medicare Part D, Medicaid, and private insurers have negotiated fixed prices for generics. If a manufacturer raises the price, they lose the contract. If they don’t raise it, they lose money. A 2025 survey of 142 generic drug makers by the Generic Pharmaceutical Association found that 67% are operating at negative or zero margins on at least one essential drug.The Domino Effect: One Shortage, Many Consequences

When one generic drug vanishes, it doesn’t just leave patients scrambling. It triggers a chain reaction. Take the case of doxycycline, a low-cost antibiotic used for everything from acne to Lyme disease. In early 2025, two major U.S. manufacturers stopped production. Why? Their API supplier in India raised prices by 35% after new export restrictions were imposed. The manufacturers tried to pass the cost to buyers. Insurers refused. One company absorbed the loss for six months. Then they shut down the line. Within three months, doxycycline shortages hit 83% of U.S. hospitals. Patients were switched to more expensive alternatives - azithromycin, tetracycline - which cost 3 to 5 times more. Insurance companies paid more. Patients paid more in co-pays. Hospitals had to use less effective substitutes. The ripple effect cost the U.S. healthcare system an estimated $1.2 billion in extra spending over just six months. The same thing happened with levothyroxine (for hypothyroidism), metformin (for diabetes), and furosemide (a common diuretic). In each case, the manufacturer wasn’t hoarding inventory or cutting corners. They simply couldn’t make money.Who’s Really Paying the Price?

It’s easy to blame big pharma. But the real problem lies in the structure of the generic drug market. There are only five major global suppliers for 70% of the world’s APIs. Three of them are based in India. One is in China. One is in Italy. If any one of them faces a regulatory crackdown, a labor strike, or a tariff spike, the entire supply chain shudders. And here’s the kicker: the U.S. government doesn’t subsidize generic drug production. Unlike vaccines or cancer drugs, there’s no financial safety net. No bulk purchasing agreements. No guaranteed minimum volumes. Manufacturers operate like commodity traders - bidding against each other for contracts, driving prices down until profit disappears. A 2025 analysis by the Congressional Budget Office found that the average profit margin on generic drugs has dropped from 14% in 2015 to just 2.3% in 2025. For some older drugs, it’s negative. That’s not a business. It’s a charity.

Why Manufacturers Can’t Just Make More

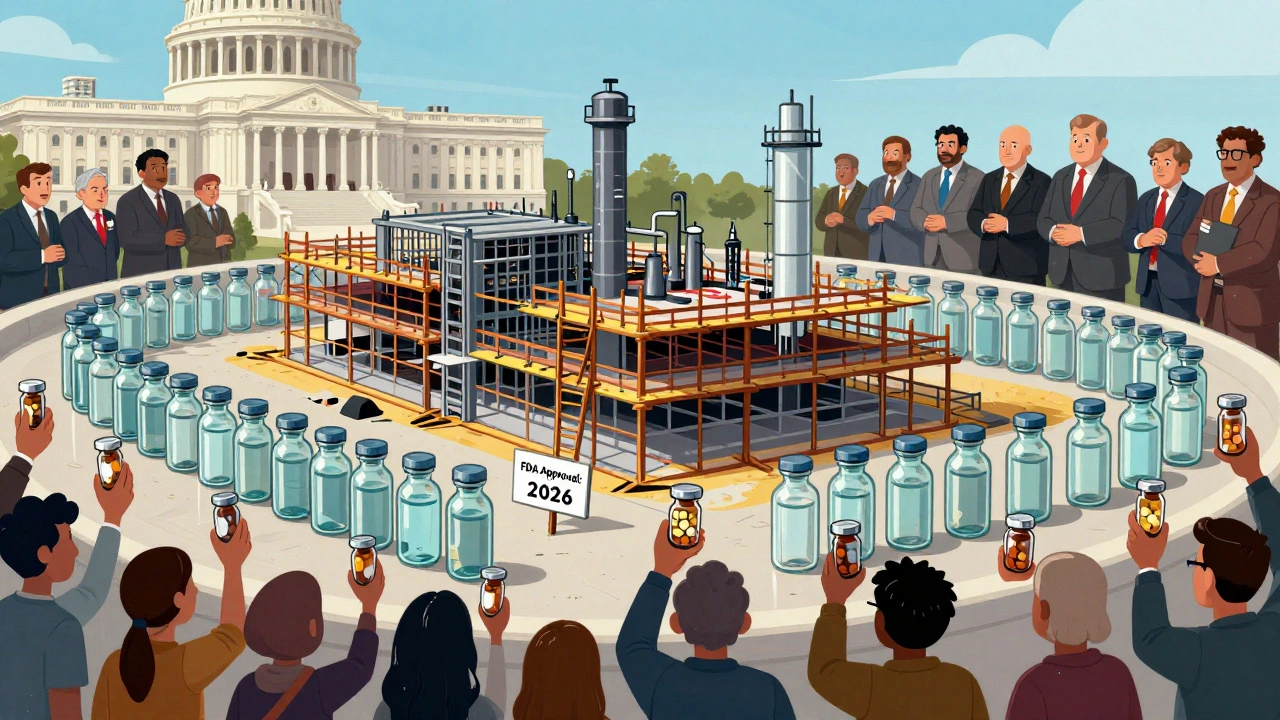

You’d think the answer is simple: build more factories. But it’s not that easy. Building a new API production facility costs between $200 million and $500 million. It takes 4 to 6 years to get FDA approval. And once built, you need a steady stream of orders to make it profitable. No manufacturer will risk that kind of capital when they can’t predict if the next batch will be sold at a loss. Even when companies try to expand, they’re blocked by supply chain bottlenecks. Equipment for sterile filling lines? Backordered for 18 months. Glass vials? Shortages due to energy costs in Eastern Europe. Even the plastic caps on bottles are harder to source. The whole system is fragile.What’s Being Done - And Why It’s Not Enough

Some solutions are being tried, but they’re too slow or too small. The U.S. government launched the Domestic Drug Manufacturing Initiative in 2024, offering $1.5 billion in grants to rebuild API production on U.S. soil. So far, only 12 projects have received funding. Most are still in planning. The first new U.S.-made API line won’t be operational until late 2026. Meanwhile, the FDA has started publishing a real-time shortage list. It’s helpful for hospitals, but it doesn’t fix the underlying economics. Manufacturers still don’t get paid more. Patients still get less. Some insurers are experimenting with “preferred manufacturer” contracts - paying a slightly higher price to companies that guarantee steady supply. But only a handful of drugs are covered. And the biggest manufacturers, who control the most volume, still refuse to play along unless they can lock in multi-year deals.

The Real Fix: Paying for What You Need

There’s one clear path forward: stop treating essential generic drugs like commodities. The U.S. and EU need to create a public-private partnership that guarantees minimum prices for critical generics - just like they do for vaccines or orphan drugs. Not high prices. Just enough to cover cost + a 5-8% margin. Enough so manufacturers can reinvest in quality, safety, and backup supply chains. Countries like Canada and Germany already do this. They negotiate long-term contracts with generic makers, guaranteeing volume and price stability. Result? Fewer shortages. Better quality control. More reliable supply. The U.S. could start with a list of 50 essential drugs - antibiotics, insulin, blood pressure meds, seizure controls, and heart medications. Set a fair price. Fund it through existing Medicare and Medicaid budgets. Let manufacturers know: if you make this, we’ll buy it. It’s not about raising drug costs. It’s about fixing a broken system that lets patients pay the price for bad policy.What Patients and Providers Can Do Now

While systemic change takes time, there are steps you can take:- If your medication is on shortage, ask your pharmacist for alternatives - not just brand-name versions, but other generics from different manufacturers.

- Check the FDA’s Drug Shortages database weekly. It’s updated in real time.

- Advocate. Call your representative. Ask why there’s no plan to protect essential drug production.

- Hospitals: build a tiered inventory system. Stock at least 90 days of critical generics. Don’t wait for the crisis to hit.

What’s Next?

Without intervention, drug shortages will keep getting worse. The FDA predicts 30% more shortages by the end of 2026. The World Health Organization warns that global access to basic medicines is now at risk. The manufacturers aren’t greedy. They’re broke. The system isn’t broken - it’s designed this way. And until we change the rules, patients will keep paying the cost.Why are generic drug prices so low if manufacturing costs are rising?

Generic drug prices are kept low by intense competition and fixed reimbursement rates from insurers and government programs. Manufacturers can’t raise prices even when costs go up because they risk losing contracts. This forces them to cut corners, reduce output, or stop production entirely - leading to shortages.

Are drug shortages only happening in the U.S.?

No. Drug shortages are a global problem, but they’re worst in countries that rely heavily on imported active ingredients - like the U.S., Canada, and much of Europe. India and China control over 80% of global API production, and any export restriction, labor strike, or tariff change there affects supply worldwide.

Can we just make more generic drugs in the U.S.?

It’s possible, but it’s slow and expensive. Building a new API plant costs $200-500 million and takes 4-6 years to get approved. Without guaranteed buyers and stable pricing, no company will risk that investment. The U.S. government’s current grants are too small and too slow to fix the problem before shortages get worse.

Why don’t insurers just pay more for generics?

Insurers negotiate fixed prices with pharmacies and manufacturers. Raising those prices would increase premiums for everyone - and trigger political backlash. So instead, they push manufacturers to lower prices further. This creates a race to the bottom, where the only way to survive is to stop making drugs that aren’t profitable.

What happens if a drug shortage lasts more than a year?

Long-term shortages can permanently break supply chains. Manufacturers may exit the market entirely. Pharmacies may stop stocking the drug. Doctors may stop prescribing it. Even if production resumes, it can take years to rebuild trust, regulatory approvals, and distribution networks. Some drugs never come back.

December 11, 2025 AT 01:43 AM

It’s not a shortage-it’s a moral failure dressed up as economics. We treat life-saving pills like bulk toilet paper and wonder why the supply chain collapses. We’ve outsourced everything except our conscience.

And yet, we still act shocked when the system designed to maximize profit fails to protect human life. The real tragedy? We knew this was coming. We just didn’t care enough to stop it.

December 11, 2025 AT 15:04 PM

EVERYTHING IS A LIE. The FDA? Controlled by Big Pharma. The ‘shortages’? Manufactured to push you toward expensive biologics. The real drug makers? Chinese labs churning out black-market generics in basements while the government watches. You think this is about money? No. It’s about control. They want you dependent on their patented $10,000-a-month miracle drugs. This? This is the beginning of the Great Pharma Takeover. Wake up.

December 12, 2025 AT 14:33 PM

It’s heartbreaking, really-how we’ve turned medicine into a market commodity, rather than a public good. We’ve built an entire system that incentivizes the cheapest option, not the most reliable one. And now, we’re reaping what we’ve sown.

Canada and Germany? They’ve known for years: if you want something essential to be available, you don’t leave it to the whims of the free market-you guarantee its viability. It’s not socialism; it’s sanity.

Why do we treat food security as a priority, but medicine as an afterthought? The logic is broken. And it’s costing lives.

Maybe it’s time we start asking not ‘how much can we pay?’ but ‘how much do we need to pay?’

December 14, 2025 AT 00:59 AM

Hey, if you’re running low on meds right now-don’t panic. Talk to your pharmacist. Ask about other generic brands. Sometimes the same pill comes from a different factory and it’s still in stock.

And if you can, reach out to your rep. A lot of people don’t realize their voice actually matters here. Small actions add up.

We’re gonna fix this. One call, one letter, one conversation at a time.

December 14, 2025 AT 10:57 AM

Of course America has shortages-because you outsourced everything to India and China while your politicians drank champagne and called it ‘free trade’!

India? They’re now hoarding APIs to feed their own population-while you cry about insulin. China? They’re playing chess while you play checkers.

Stop begging for handouts from foreign regimes and build your own factories! We made penicillin in the 1940s-we can do it again! But no, you’d rather complain and blame ‘capitalism’ while your grandpa skips his blood pressure pills.

Pathetic.

December 16, 2025 AT 09:21 AM

The structural flaw here is not merely economic-it’s epistemological. We’ve conflated price with value, and volume with sustainability. The market mechanism, when unmoored from public health imperatives, becomes a self-cannibalizing apparatus.

Consider: the marginal cost of producing a tablet of metformin is approximately $0.03. The market price? $0.05. That’s not ‘low margin’-it’s a subsidy to systemic neglect.

Meanwhile, the capital expenditure for FDA-compliant API production is $387 million on average, with a 5.2-year regulatory lag. No rational actor invests in negative-NPV projects. Ergo: collapse.

The solution? A public utility model for essential generics. Not ‘subsidies.’ Not ‘grants.’ A legally binding, price-stabilized, volume-guaranteed national procurement mechanism. Think Medicare, but for pills.

It’s not radical. It’s merely competent.

December 17, 2025 AT 07:11 AM

Thank you for this thorough and sobering analysis. The data is clear, the stakes are high, and the solutions, while complex, are not beyond reach.

I’ve worked in hospital pharmacy for 22 years. I’ve seen shortages come and go. But this is different. This isn’t a glitch. It’s a systemic unraveling.

The fact that we’re discussing whether to pay 5% more for insulin to prevent deaths should be unthinkable. It’s not. And that’s the real crisis.

I hope policymakers read this. Not because it’s trendy-but because it’s true.

December 18, 2025 AT 22:22 PM

Just read the FDA’s latest shortage list. 47 drugs on it. 12 are antibiotics. 8 are insulin. 5 are blood pressure meds.

We’re not talking about rare cancer drugs here. We’re talking about what people take every single day to stay alive.

And nobody’s talking about it on the news.

That’s the real problem.