When you pick up a prescription, the price on the receipt isn’t just the cost of the medicine. It’s your copay - the fixed amount you pay out of pocket, while your insurance covers the rest. But here’s the thing: if you’re on a generic drug, you might pay $5. If it’s the brand name version of the same drug, you could pay $100. That’s not a mistake. It’s how the system works.

Why Do Generic and Brand Copays Cost So Differently?

Generic drugs are chemically identical to their brand-name counterparts. They work the same way. They’re just cheaper to make because they don’t need to pay for research, marketing, or patent protection. That’s why insurance plans push them hard - they save money for everyone. In 2024, most U.S. prescription drug plans use a four-tier system:- Tier 1: Preferred Generic - Usually $0 to $10

- Tier 2: Non-Preferred Generic - Around $10 to $15

- Tier 3: Preferred Brand - Median $47

- Tier 4: Non-Preferred Brand - Median $100

Medicare Advantage vs. Standalone Drug Plans: Big Differences

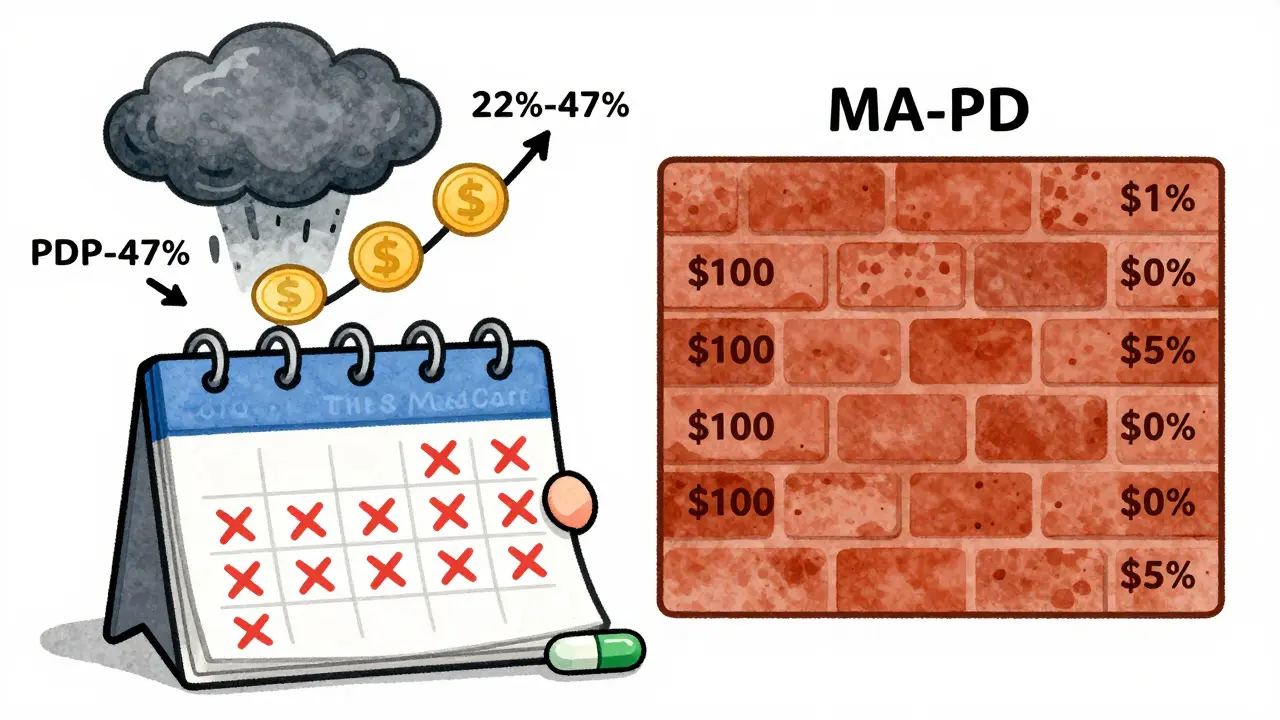

If you’re on Medicare, your out-of-pocket costs depend heavily on what kind of plan you have.- Medicare Advantage Prescription Drug (MA-PD) plans - 97% of these use fixed copays. That means you know exactly what you’ll pay: $47 for a preferred brand, $100 for a non-preferred one.

- Standalone Prescription Drug Plans (PDPs) - Most use coinsurance instead. That’s a percentage of the drug’s total price. For brand name drugs, it’s often 22% to 47%. If your drug costs $200, you pay $44 to $94. If it costs $500? You pay $110 to $235.

What About Commercial Insurance?

Private insurers follow similar rules, but they can be even trickier. Some plans use a policy called “Member Pay the Difference.” Here’s how it works: if your doctor prescribes a brand name drug but a generic is available and approved, you pay your normal copay plus the full price difference between the brand and the generic. Example: Your generic atorvastatin costs $12. The brand Lipitor costs $150. Your copay is $20. But because a generic exists, you pay $20 + ($150 - $12) = $158. That’s not a typo. You’re paying almost the entire cost of the brand name drug. This policy is common in Bronze and Silver plans. It’s designed to force people to choose the cheaper option. But if your doctor says you can’t switch - maybe you had side effects, or the generic doesn’t work for you - you’re still stuck with the bill.

The Real Cost: Annual Spending Adds Up Fast

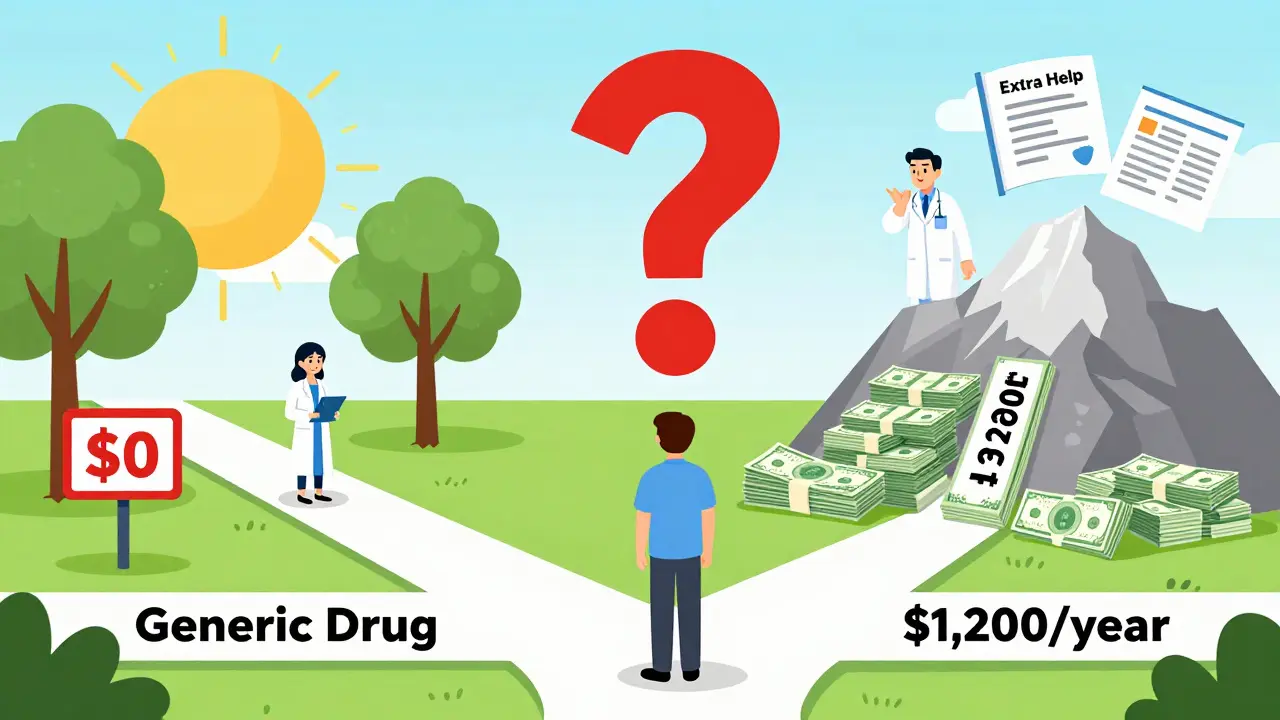

A $47 monthly copay for a brand drug sounds manageable. Until you do the math.- $47 x 12 months = $564 per year

- $100 x 12 months = $1,200 per year

- Two brand drugs? $2,400 - and that’s before you hit the coverage gap.

Who Gets Hit the Hardest?

The Medicare Rights Center surveyed 1,200 beneficiaries in 2024. Here’s what they found:- 63% of people taking brand name drugs said they struggled to afford them.

- Only 28% of people on generics said the same.

- 37% of all prescription drug complaints in Q1 2024 were about unexpected brand name costs.

How to Save Money - Right Now

You don’t have to accept these prices. Here’s what actually works:- Check your plan’s formulary. Every plan must publish it by October 15 each year. Look up your exact drug. Not the name - the exact dose and form (tablet, capsule, extended-release).

- Use the Medicare Plan Finder. Enter your drugs. Compare plans side by side. A plan with $0 generics and $40 brand copays might cost you $480 a year. One with $5 generics and $100 brand copays? $1,200.

- Ask for therapeutic alternatives. 72% of Medicare plans have a cheaper generic or brand alternative for common drugs. Your doctor might not know. Ask: “Is there another drug on Tier 1 or 2 that works the same?”

- Ask about cash prices. Sometimes, paying cash at Walmart or Costco is cheaper than your copay. A 30-day supply of metformin can cost $4 cash. Your copay? $10.

- Apply for Extra Help. If your income is low, you may qualify for a program that caps your generic copays at $4.50 and brand at $11.20.

What’s Changing in 2025?

The Inflation Reduction Act is reshaping this landscape.- By 2025, 98% of Medicare Part D plans will have $0 preferred generic copays.

- The annual out-of-pocket cap for all drugs will be $2,000.

- Insulin will stay capped at $35 per month - no matter if it’s brand or generic.

Bottom Line: Know Your Plan. Ask Questions.

Generic and brand copays aren’t about quality. They’re about cost control. Insurance companies want you to pick the cheaper option. But if you can’t - because of side effects, allergies, or medical necessity - you shouldn’t be punished with a $100 bill. The system is designed to make you jump through hoops. But you don’t have to play along blindly. Check your formulary. Compare plans. Ask your pharmacist: “Is there a cheaper version?” Ask your doctor: “Can we try a Tier 1 drug?” You’re not just a patient. You’re a consumer. And you have the right to know what you’re paying - and why.Why are generic drug copays so much lower than brand name copays?

Generic drugs cost less to produce because they don’t require expensive research, marketing, or patent protection. Insurance plans reward their use by putting them on lower-cost tiers - often $0 to $10 per fill. Brand name drugs, which are still under patent or marketed aggressively, are placed on higher tiers with copays ranging from $47 to $100 or more. This structure encourages patients to choose generics when clinically appropriate, lowering overall drug spending.

Can I be charged extra for choosing a brand name drug over a generic?

Yes. Some insurance plans, especially commercial ones, use a “Member Pay the Difference” policy. If a generic is available and approved, you pay your regular copay plus the full price difference between the brand and the generic. For example, if your generic costs $12 and the brand costs $150, you pay your $20 copay plus $138 - totaling $158. This policy is legal and common in Bronze and Silver plans.

How do Medicare Advantage and standalone drug plans differ in copay structure?

Medicare Advantage Prescription Drug (MA-PD) plans mostly use fixed copays - you pay $47 or $100, no matter the drug’s actual price. Standalone Prescription Drug Plans (PDPs) mostly use coinsurance - you pay a percentage (like 22% to 47%) of the drug’s total cost. That means if the drug price goes up, your payment goes up too. MA-PD plans offer more predictability; PDPs can lead to higher, variable costs.

What’s the average cost of a brand name drug copay in 2024?

In 2024, the median copay for a preferred brand name drug in Medicare Part D plans was $47. For non-preferred brand drugs, it was $100. These are fixed amounts for Medicare Advantage plans. For standalone drug plans, many use coinsurance instead - typically 22% to 47% of the drug’s total price - which can be higher or lower depending on the drug’s cost.

Are there ways to lower my prescription drug costs if I’m on brand name medications?

Yes. First, check if a generic or alternative drug on a lower tier works for you. Second, use the Medicare Plan Finder to compare plans based on your exact medications. Third, ask your pharmacy for the cash price - sometimes it’s cheaper than your copay. Fourth, if your income is low, apply for Extra Help, which caps generic copays at $4.50 and brand at $11.20. Finally, ask your doctor to write “dispense as written” if you can’t switch - this may prevent the “pay the difference” penalty.

January 29, 2026 AT 07:52 AM

This is why America is BROKE. 🤦♂️ You think this is fair? I pay $100 for my blood pressure med while some guy gets it for $5. This isn't healthcare-it's corporate robbery. #MedicareScam

January 31, 2026 AT 04:52 AM

People who choose brand-name drugs over generics are just being irresponsible. If you can't afford your meds, maybe you shouldn't have taken out that $80k student loan to become a yoga instructor. 🙄

February 1, 2026 AT 21:29 PM

Look, I get it. Generics work. I’ve been on them for years. But here’s the thing-sometimes they don’t work for you. I had a seizure on generic levothyroxine. My doc said ‘it’s the same chemically’ but my body said ‘nope.’ Now I pay $90 a month and I’m alive. So don’t act like it’s just about money. It’s about your body not being a lab rat.

February 2, 2026 AT 12:42 PM

You’re not alone! I used to stress over my $110 brand copay until I found out my local Costco sells the same drug for $12 cash. I’ve been doing this for 2 years now-no insurance needed. Seriously, check cash prices before you pay anything. It’s wild how many people don’t know this!

February 3, 2026 AT 06:52 AM

The entire system is a mathematical optimization problem designed to externalize costs onto the most vulnerable. Insurance companies use tiered copays not to incentivize cost-effective care, but to maximize profit margins by exploiting behavioral economics. The Inflation Reduction Act’s $2k cap is a band-aid on a hemorrhage. The real issue? Pharmaceutical monopolies enabled by patent evergreening and CMS’s refusal to negotiate prices. You think $100 is bad? Wait till you see what happens when biosimilars get blocked by PBMs.

February 3, 2026 AT 07:06 AM

This is actually really helpful. I had no idea about the cash prices being cheaper than copays. I’m going to ask my pharmacist tomorrow. Small steps, right? Thanks for laying it out like this.

February 4, 2026 AT 22:34 PM

It is imperative that patients exercise due diligence in reviewing their formularies and engaging in proactive dialogue with their prescribing clinicians. The structural inequities within the U.S. pharmaceutical reimbursement model necessitate a consumer-driven approach to mitigate undue financial burden. One must not assume that the default prescription is the most economically viable option.

February 4, 2026 AT 22:36 PM

I mean, if you're on Medicare, you're basically just a ward of the state. Why are you even surprised? I paid $380 for my brand-name insulin last year-because I didn't want to be on some generic that might 'not work.' People who complain about copays are just lazy. If you can't afford it, get a better job.

February 5, 2026 AT 23:33 PM

The ‘Member Pay the Difference’ policy is a violation of the implied covenant of good faith. It’s not just unethical-it’s predatory. You’re being punished for your doctor’s lack of transparency. This isn’t capitalism. This is feudalism with a pharmacy receipt.

February 6, 2026 AT 13:32 PM

I knew it. This is all part of the Great Pharma Conspiracy. They want you to get sick so they can sell you more drugs. They’re secretly replacing generics with fake versions that don’t work. I checked the bottle-there’s a tiny QR code that says ‘Beware the Tier 1 Trap.’ I’m not taking anything until Congress bans all patents. #PharmaLies

February 6, 2026 AT 16:36 PM

I’m British and I’m still shaking. You guys pay $100 for a pill? In the NHS, I get my statins for free. I just walk in, say ‘I need my cholesterol stuff,’ and they hand it over. No forms. No tiers. No drama. You’re living in a dystopian nightmare and you’re all just… accepting it?

February 8, 2026 AT 14:20 PM

Biggest tip I ever got: call your pharmacy and ask ‘What’s the cash price for this?’ 7 out of 10 times it’s cheaper than my copay. I saved $400 last year just by doing that. Also-Extra Help is way easier to get than people think. I applied online in 15 minutes. Took 3 weeks. Now my generics are $4.50. Game changer.

February 10, 2026 AT 02:12 AM

I used to think generics were just ‘the same but cheaper.’ Then I got prescribed a brand-name antidepressant after three generics messed with my sleep. Turns out, the fillers and binders? Totally different. My body didn’t care about the active ingredient-it cared about the little extras. Now I’m on a $75/month drug. I don’t complain. I just make sure my doc writes ‘dispense as written.’ You don’t know what your body needs until you’ve been through the wringer. Stay curious.