What Are Manufacturer Savings Programs for Brand Drugs?

Manufacturer savings programs are financial tools created by drug companies to help people pay for expensive brand-name medications. These aren’t charity programs-they’re designed to make it easier for patients to afford drugs that cost hundreds or even thousands of dollars a month. The two most common types are copay cards and patient assistance programs (PAPs). Copay cards reduce your out-of-pocket cost at the pharmacy, often cutting your monthly bill by 70% to 85%. PAPs are usually for people with very low income who don’t have insurance, but some also help those with insurance if their costs are still too high.

These programs became widespread in the early 2000s as insurance plans started shifting more costs to patients. Today, nearly one in five prescriptions for brand drugs in the U.S. uses some kind of manufacturer discount. For example, if you’re taking Jardiance for diabetes and your monthly cost is $562, a copay card might drop that to just $100. That’s the kind of relief these programs offer.

Who Can Use These Programs?

Not everyone qualifies. The biggest rule? You can’t be on Medicare, Medicaid, or any other federal health program. That’s because federal law bans drugmakers from giving discounts to people on these programs-it’s seen as an illegal kickback that could push patients toward pricier brand drugs instead of cheaper generics.

That leaves people with private insurance as the main group eligible. If you have coverage through your employer, a plan bought on the Health Insurance Marketplace, or even a spouse’s plan, you’re likely eligible. But here’s the catch: your insurance plan might have something called an accumulator adjustment program. These programs, used by 87% of large employers as of 2022, don’t let the manufacturer discount count toward your deductible or out-of-pocket maximum. That means you’re still paying full price toward your plan limits, even though your pharmacy bill looks lower.

Check your insurance documents or call your insurer to ask: "Does my plan allow manufacturer coupons to count toward my deductible?" If the answer is no, you’re getting a discount on your monthly payment-but not on your overall financial responsibility to the plan.

How to Find and Enroll in a Program

Start by going to the drug manufacturer’s official website. Type in the name of your medication, then look for "Savings," "Assistance," or "Patient Support." Most big brands like Humira, Ozempic, or Advair have dedicated pages for this. You can also use trusted third-party sites like GoodRx or NeedyMeds, which list programs for hundreds of drugs.

Once you find the right program, you’ll need to fill out a short online form. You’ll typically need:

- Your full name and date of birth

- Your insurance information (plan name, member ID)

- Your doctor’s name and prescription details

- Proof of income if applying for a PAP

After submitting, you’ll get a digital card via email or text, or sometimes a physical card in the mail. Some programs even let you link the card directly to your pharmacy app. The card doesn’t work like a credit card-it’s a unique code that your pharmacist enters when processing your prescription. The system automatically applies the discount.

How the Discount Works at the Pharmacy

When you show up to pick up your prescription, hand over your copay card just like you would your insurance card. The pharmacist scans it, and the system connects to a third-party administrator-companies like ConnectiveRx or Prime Therapeutics-that handles the discount behind the scenes.

Here’s what happens next: the pharmacy charges your insurance the full list price of the drug. Then, the third-party admin applies the manufacturer discount to your portion. Your insurance pays its share, the manufacturer pays the difference to the admin, and you pay only your reduced copay. You never see the full price. That’s why your receipt might show a higher amount than what you paid.

But this system has a flaw: it hides the true cost of the drug from your insurance company. That’s part of why drug prices keep rising-because patients aren’t feeling the full cost, there’s less pressure on manufacturers to lower prices.

What You Can’t Expect

These programs aren’t magic. They come with limits:

- Annual caps: Most programs cap savings at $5,000 to $15,000 per year. Once you hit that limit, you pay full price again until the next calendar year.

- Time limits: Many programs last only 12 to 24 months. After that, you have to reapply. Some companies automatically renew you, others don’t.

- Plan exclusions: Some insurance plans don’t work with certain programs. If your pharmacy says the card doesn’t work, it’s not your fault-it’s a system mismatch.

- No generics: These discounts only apply to brand-name drugs. If your doctor switches you to a generic, you lose the savings.

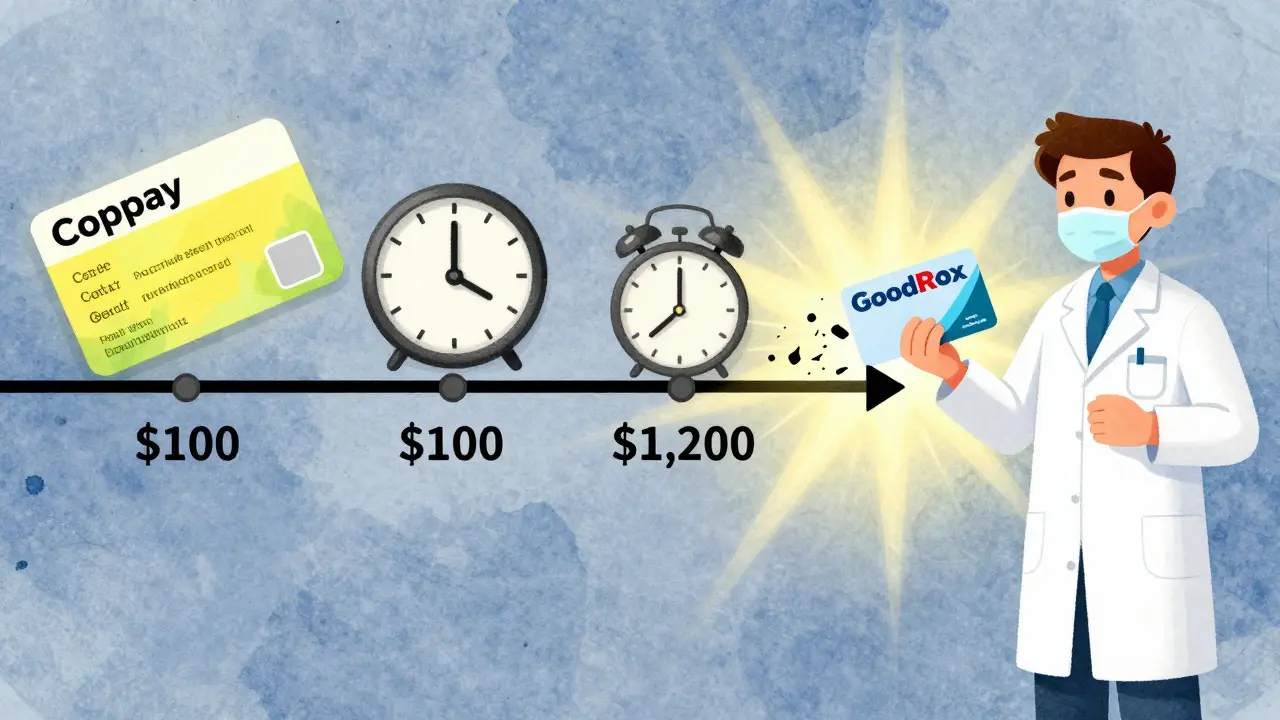

One patient on Reddit shared that after Humira’s coupon program ended, their monthly cost jumped from $100 to $1,200 overnight. That’s why it’s smart to know your program’s end date and plan ahead.

Manufacturer Programs vs. Pharmacy Discount Cards

Don’t confuse manufacturer savings with pharmacy discount cards like GoodRx or SingleCare. Here’s the difference:

| Feature | Manufacturer Savings Programs | Pharmacy Discount Cards (e.g., GoodRx) |

|---|---|---|

| Eligibility | Only for people with private insurance | Anyone-even if you have no insurance |

| Discount Type | Copay reduction (70-85% off) | Flat price reduction (30-60% off) |

| Applies to Generics? | No | Yes |

| Counts Toward Deductible? | Usually not (due to accumulator programs) | No (these aren’t insurance) |

| Annual Cap | Yes ($5K-$15K) | No |

| Expiration | Usually 1-2 years | Never expires |

GoodRx is great if you’re uninsured or want to compare prices across pharmacies. But if you have insurance and qualify for a manufacturer program, you’ll usually save more with the copay card.

Common Problems and How to Solve Them

Even when you do everything right, things go wrong. Here are the most common issues:

- "Your card doesn’t work at this pharmacy." Try a different pharmacy. Not all pharmacies are connected to every manufacturer’s system. Chain pharmacies like CVS, Walgreens, and Rite Aid usually have the best coverage.

- "I was approved, but now I’m being charged full price." Call your insurer and ask if they’ve implemented an accumulator program. If yes, ask your doctor if a generic or lower-cost alternative is possible.

- "My program just ended and my bill doubled." Contact the manufacturer immediately. Some offer grace periods or extended support. If not, ask your doctor about switching to a similar drug with a better savings program.

- "I don’t understand the paperwork." Pharmacists are your best resource. A 2023 KFF study found 65% of patients need help from their pharmacist just to enroll. Don’t be embarrassed to ask.

What’s Changing in 2026?

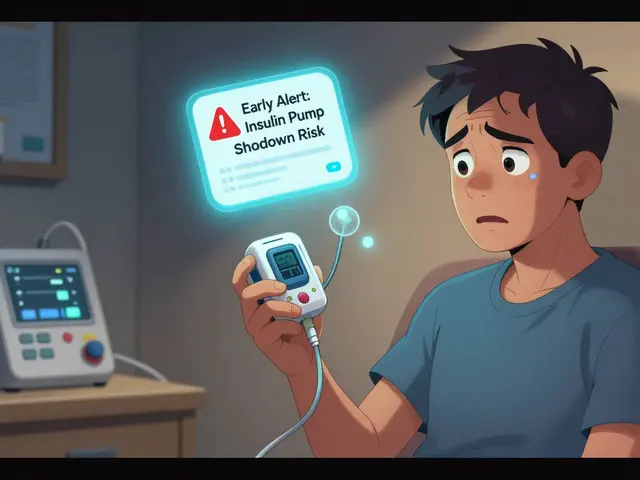

The landscape is shifting. In 2022, the Inflation Reduction Act capped insulin costs at $35 per month for Medicare patients. That’s already reduced the need for insulin manufacturer coupons among seniors. More changes are coming.

Thirty-two states have passed laws forcing insurers to count manufacturer discounts toward deductibles. But federal rules still block these discounts for Medicare and Medicaid. Meanwhile, new bills like the 2023 Fair Deal for Patients Act are pushing to make all manufacturer assistance count toward out-of-pocket limits nationwide.

Drugmakers are also under more scrutiny. The FDA now requires clearer disclosures on coupon ads, and Congress is debating whether these programs are driving up overall drug prices. Some experts say they’re a lifeline for patients. Others say they’re a tool that keeps prices high.

What You Should Do Right Now

If you’re paying a lot for a brand-name drug, here’s your action plan:

- Check your prescription cost. If it’s over $100/month, look into savings programs.

- Go to the manufacturer’s website and search for your drug’s name + "savings program."

- Confirm you have private insurance and aren’t on Medicare or Medicaid.

- Call your insurer and ask if your plan uses accumulator adjustments.

- Enroll in the program and save the confirmation email.

- Set a reminder 30 days before your program expires.

- Keep a backup plan: know the GoodRx price for your drug in case the coupon stops working.

For many, these programs mean the difference between taking their medication or skipping doses. Used wisely, they can save you $5,000 to $15,000 a year. But they’re not permanent. Stay informed, stay proactive, and never assume your discount will last forever.

Frequently Asked Questions

Can I use a manufacturer savings program if I have Medicare?

No. Federal law prohibits drug manufacturers from offering discounts to people on Medicare, Medicaid, or other government health programs. This is to prevent financial incentives that could push patients toward more expensive brand drugs. If you’re on Medicare and need help with drug costs, check out the Medicare Part D Low-Income Subsidy program or ask your pharmacist about alternative options.

Do manufacturer coupons work with all pharmacies?

Not always. Most major chains like CVS, Walgreens, and Rite Aid accept these programs, but smaller independent pharmacies may not be connected to the third-party administrators that process the discounts. If your card doesn’t work, ask your pharmacist if they can switch to a different pharmacy that does. You can also use the manufacturer’s website to find a list of participating pharmacies near you.

Why does my insurance say I’m paying more even though I used a coupon?

This is likely due to an accumulator adjustment program. These plans allow you to pay less at the pharmacy, but they don’t count the manufacturer discount toward your deductible or out-of-pocket maximum. So while your monthly bill is lower, you’re still responsible for paying the full price of the drug toward your plan limits. Ask your insurer if your plan uses accumulators and whether you can switch to a different plan during open enrollment.

Can I use a manufacturer coupon and a GoodRx card together?

No. You can only use one discount at a time. The pharmacy’s system will pick the best one for you, but you can’t stack them. Always compare the final price you’d pay with each option before choosing. Sometimes, GoodRx offers a lower price than your copay card, especially if your manufacturer program has expired or has a cap.

What happens when my manufacturer coupon expires?

Once your coupon expires, you’ll pay your full insurance copay-or the full price if you haven’t met your deductible. Some manufacturers automatically renew your coupon if you’re still eligible, but many require you to reapply. Set a reminder 30 days before expiration. If you can’t reapply, talk to your doctor about switching to a similar drug with a better program, or ask if a generic version is available.

February 2, 2026 AT 05:48 AM

So let me get this straight: drug companies are basically bribing patients to stay on expensive brand-name meds while laughing all the way to the bank? And we call this "savings"?

Meanwhile, my deductible is still $7,000 and I’m paying $100/month because the system is rigged. I’m not mad, I’m just disappointed.

February 3, 2026 AT 06:48 AM

omg i just found out my copay card doesnt count to my deducible and i thought i was doing so good?? like i was so proud of only paying 80 bucks a month for my ozempic but turns out im still on the hook for like 15k?? this is so messed up. i feel so dumb now. my ins co never told me. they just said "here’s your discount" and i was like yay! 🤦♀️

February 4, 2026 AT 01:50 AM

I’m not saying we should abolish these programs… but maybe if we stopped letting Big Pharma turn our prescriptions into a casino game, we wouldn’t need them in the first place? 🤡

Also, I just got a text from my pharmacy saying my Humira card expired. My bill went from $100 to $1,200. I cried in the parking lot. No emoji can fix this.

February 4, 2026 AT 17:08 PM

Dont panic. You got this. Check GoodRx first. Sometimes it’s cheaper than your copay card. And if your doc can switch you to a similar drug with better savings? Do it. You’re not alone. I’ve been there. Talk to your pharmacist-they’re your secret weapon.

February 5, 2026 AT 18:11 PM

I think the real issue here is that we’re treating medication like a luxury item instead of a basic need. These programs are a band-aid on a bullet wound.

But I’m glad people are finding ways to survive. I used a PAP last year for my insulin and it kept me alive. I just wish we lived in a world where I didn’t have to play this game to stay healthy.

February 7, 2026 AT 06:17 AM

You people are so naive. These programs exist because drug companies know you’ll pay anything to stay alive. They’re not helping you-they’re manipulating you into paying more over time.

And don’t even get me started on accumulator programs. That’s corporate greed dressed up as customer service. You’re being played.

February 8, 2026 AT 01:59 AM

The article is factually accurate, but it lacks critical context regarding the moral hazard inherent in manufacturer-sponsored copay assistance. By insulating consumers from true pricing signals, these programs distort market competition and incentivize the overprescription of higher-cost therapeutics.

Furthermore, the implicit endorsement of these programs by third-party aggregators like GoodRx constitutes a form of market interference that undermines the efficacy of value-based formularies. One might argue that this is a systemic failure of pharmaceutical policy, not merely a patient navigation issue.

February 8, 2026 AT 17:44 PM

I’m from a country where insulin costs $5 and people don’t have to choose between food and medicine. It breaks my heart to see how broken this system is.

I know these programs help people survive. I’m not saying they’re bad. But we need to fight for change-not just patch the holes. Your life shouldn’t depend on a coupon code.

And yes, I cried too when my card expired. You’re not alone.

February 9, 2026 AT 16:36 PM

I used to think these cards were a win until I realized my insurance was still charging me full price toward my max.

My pharmacist saved me. She told me to ask for a different drug with a better program. Switched to a similar med-same results, $20/month.

Don’t just accept what you’re given. Ask. Push. Advocate. You’ve got more power than you think.

February 10, 2026 AT 21:42 PM

Just enrolled in my Jardiance program! 😍 $100 down to $15. My bank account is crying happy tears. 🙌

February 11, 2026 AT 01:44 AM

i didnt even know this was a thing until my mom told me about her card for her blood pressure med. she said the pharmacist helped her sign up and it cut her bill in half. i cried. i feel so lucky. thank you to everyone who works in pharma support. you guys are angels.